The ACA Marketplace is an online portal that contains information on the various Medicare and Medicaid programs. Before enrolling with any plan, consumers need to know the type of coverage they need for their current health condition. There are seven different plans that are offered by the ACA Marketplace:

Consumers are typically able to compare all the different ACA Marketplace plans with one simple click of a button. However, consumers need to know more about pre-existing conditions before signing up with any plan. Pre-existing conditions can negatively affect the cost and coverage of any policy. As such, consumers need to be aware of this important fact before enrolling in any ACA marketplace plans.

Consumers who want to see the figure of all the different plans at once should turn to a web broker. A web broker will be able to provide this valuable service because he or she is well versed with all the different plans that are available. Additionally, these individuals will be able to show all the different conditions that will negatively impact one’s health care costs after signing up with the specific company. In addition, a good web broker will be able to provide consumers with an online calculator so that they can see the effect that certain pre-existing conditions would have on their individual premiums.

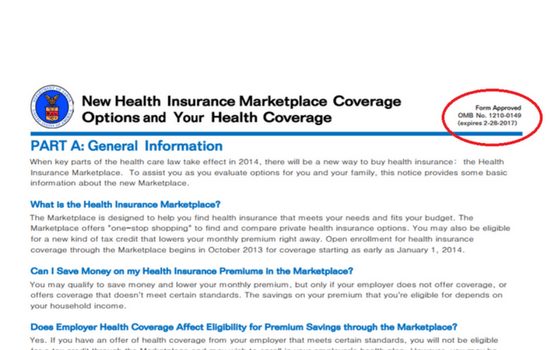

However, there are a few steps that must be followed to take advantage of the services offered by ACA. One of these steps is direct enrollment. Direct enrollment allows consumers to enroll in health plans through the Internet. By doing so, consumers will be able to get the benefits from their chosen ACA plan by simply filling out a short form on the company’s website. After doing so, all consumers will receive the same letter from the company offering them direct enrollment.

Some people believe that by choosing to go with ACA, they are limiting their options. However, this is not the case as other companies in the marketplace offer similar direct enrollment services. Furthermore, ACA also has a substandard plans option. If a person does not want standard coverage but rather wants plans with more expensive premiums, then they should be able to find a substandard plan in the ACA premium marketplace.

These days, many consumers are finding it difficult to make ends meet. Because of this, many companies have found that it is advantageous to provide consumers with direct enrollment services online. By doing so, these companies can help millions of people sign up for qualified health plans, many of which they would never have been able to find on their own. Fortunately for consumers, many web brokers in the ACA marketplace today offer these direct enrollment services. As such, it is easy for consumers to find affordable and quality substandard plans in the marketplace coverage area.

Let’s Get Started Today

You may qualify for a large subsidy, that results in a $0 premium. Take action today!

“The agent that helped me find the correct plan with for my growing family is the best. I think that her goal was the fitting us in the best plan for us, not her commission”

A Recent Client

Florida Resident