It can be a real challenge for an unemployed person to acquire health insurance cover, especially when faced with skyrocketing premiums and co-payments. However, it’s not impossible to acquire health care coverage if you’ve been unemployed for a while. There are several measures you can take to ensure that you obtain proper health care coverage.

One of the primary measures you can take to assure yourself of obtaining health cover if you’ve been unemployed is to seek out a medical care program that’s specifically designed for unemployed individuals. Medical coverage for unemployed individuals is one of the more affordable ways to get yourself covered. You can do this by enlisting the aid of non-profit organizations that provide care to those who aren’t able to afford medical coverage on their own. However, be aware that just because a particular organization provides for uninsured individuals doesn’t mean that it provides adequate medical coverage. You’ll want to thoroughly review any plans offered before signing on the dotted line.

Another approach that can allow you to get the medical coverage you need despite being unemployed is to consider enrolling in a medical “coverage” plan offered by your employer. In many cases, you’ll find that most large employers offer some form of medical coverage for their employees. The catch is that you’ll have to pay part of your monthly premium to receive this benefit – so it may be your best bet to look for a “coverage” plan that doesn’t require you to pay anything upfront.

If you’ve already applied for health insurance through your employer, you may have noticed a significant difference in the cost of your premiums. Unfortunately, this isn’t always the case. Unfortunately, companies are legally required to provide health insurance to their employees even when they’re unemployed. This may be due to a mandate approved by the government – or it may simply be the cost of doing business for them that forces them to provide insurance at all. To avoid paying the full amount of your premium for a plan you don’t need, you may wish to inquire about a short-term policy. These policies typically last anywhere from six to 12 months and can help you to avoid paying the full price for the coverage you no longer need.

If you’re looking for health insurance while unemployed, you also have the option of turning to “agreed upon” contracts between yourself and your current employer. If you’ve been working for the same company for an extended period, they may be willing to set up an agreement in which you receive full continuation of coverage without any hikes in your bill. Unfortunately, this option usually only lasts until your contract expires. If you wish to maintain continuous coverage for a longer period, it may be in your best interest to look for an alternative.

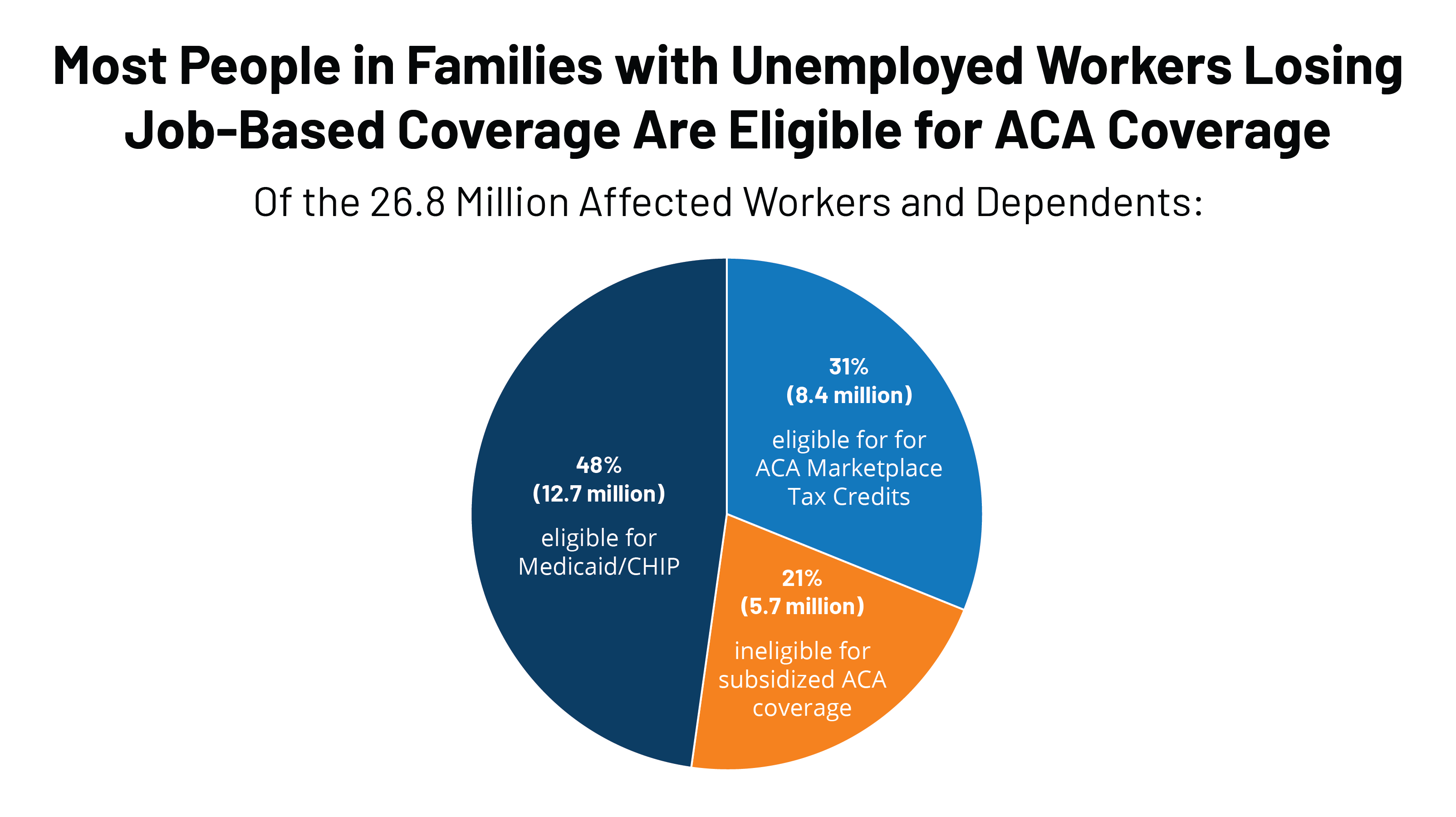

How to get your health insurance subsidy if you’ve been unemployed is an important consideration for anyone who’s lost their job. Even if you’ve become disabled by the loss of your job, it doesn’t necessarily mean you’ll never be able to find work again. However, it can make a difference in your ability to pay for health insurance every month. As such, it’s very important to make sure you take the proper steps to make sure you don’t become another unemployed statistic.

Let’s Get Started Today

You may qualify for a large subsidy, that results in a $0 premium. Take action today!

“The agent that helped me find the correct plan with for my growing family is the best. I think that her goal was the fitting us in the best plan for us, not her commission”

A Recent Client

Florida Resident